Insurance agents are the faces of Insurance industries and are the best friends for an insured in distress. So this blog article is being ...

Insurance agents are the faces of Insurance industries and are the best friends for an insured in distress. So this blog article is being made for those of you who want to become an Insurance agent – to tell how to become an Insurance agent. It at first tells you what are the eligibility required, what training you have to go through and what exam you have to qualify to be a licensed Insurance agent. It also touches upon what are the roles of Insurance agent and what monetary benefit you can expect by doing the job of an insurance agent. In a subsequent blog article titled: Insurance agent job notification - list of websites, I would tell you where to look for the Insurance agent job opportunity.

Insurance agents are the faces of Insurance industries and are the best friends for an insured in distress. So this blog article is being made for those of you who want to become an Insurance agent – to tell how to become an Insurance agent. It at first tells you what are the eligibility required, what training you have to go through and what exam you have to qualify to be a licensed Insurance agent. It also touches upon what are the roles of Insurance agent and what monetary benefit you can expect by doing the job of an insurance agent. In a subsequent blog article titled: Insurance agent job notification - list of websites, I would tell you where to look for the Insurance agent job opportunity. Roles of an Insurance agent:

Roles of an Insurance agent:

Insurance agents plays the role of an intermediary in between the Insurance organisation and the Insured. While on behalf of the Insurance organisation they are supposed to sell the insurance policies, on behalf of the insured they are supposed to service the policies – help in payment of the premiums, settle claims etc.

How much does an Insurance agent earns:

There is no limit – it depends on how many insurance policies you can sale in any period, as earning of an Insurance agent is based on commission structure – a certain percentage of premium paid by the insurer.

Vivek Gupta, a Development Officer in LIC has an interesting presentation on what are the benefits of becoming an insurance agent. As per the presentation, if you can sell a policy of Rs. 5 Lakhs for a 21 Year Term, annual premium is Rs. 25,000/-. With this premium, commission earned by an agent is:

1st year: 35% of premium Rs. 25,000/-: Rs. 8,750/-.

2nd & 3rd year: 7.5% of premium Rs. 25,000/-: Rs. 1,875/- per year.

For the remaining 18 years: 5% of premium Rs. 25,000/-: Rs. 1,250/- per year.

Thus by selling a single policy of 5 lakhs with premium 25,000/- rupees per year, you can earn: Rs. 8750+1875+1875+22500=Rs. 35000.

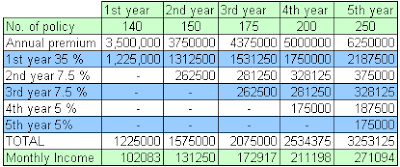

Now if you can sell 140 such policies in a year (just over 11 policy per month), you can earn as much as Rs. 12.25 lakh per year, which is more than 1 lakh per month. Mr. Gupta gives you the following target-chart for a five-year period (with number of policy to sell increasing from 140 in the first year to 250 in the fifth year):

You can download this interesting ppt presentation from this slideshare link.

Interested already? Read on.

Minimum Eligibility required to be an Insurance agent:

Age: Minimum 18 years.

Educational Qualification: Minimum Class-XII or equivalent if you hail from a place with population 5000 or more. Or else, minimum Class-X or equivalent.

Above are compulsory eligibility. On top of it, if you want to become a successful insurance agent, you of course need to have the knack of approaching a stranger and have the salesmanship to sale an insurance service.

LIC prescribes following traits to be seen in you as an Insurance agent:

Self-motivation

A master communicator

A go-getter

A graduate

It says you are going to succeed as an Insurance agent if have following personality traits:

You are outgoing and like meeting people

You are ambitious to own a business

You only want your clients to be your bosses

You want to decide your working hours

IRDA Pre-licensing training to become an Insurance agent – the initiation:

You have to undergo practical training of 50 hours (spread over 3 weeks) for either General insurance agent or Life insurance agent. For composite insurance (Life-cum-General) agents, the duration of the training is 75 hours (spread over 4 weeks). If you posses certain extra professional qualification, there is relaxation of above training hours.

For license renewal of existing agents, the hours of training required is 25 hours (for general insurance) and 50 hours for composite insurance agents.

These training are conducted at IRDA approved training centers.

You do not need to pay anything for these trainings. The Insurance organisation for which you want to become an agent sponsors you for these trainings. However, you will need to pay a sum of approx. Rs. 600 as DD to the Insurance organisation for Examination Fees (Rs. 350/=) & License Fee (Rs. 250/=). The examination is conducted by Insurance Institute of India and license is awarded by IRDA.

So once the job notification comes up for any Insurance organisation, approach their office who will upload your details (including photograph and signature) on IRDA Portal and guide you on your further course of action – like training and Prelicencing exam.

Prelicencing Exam for Insurance agent:

There are two Prelicencing exams, which you have to undergo before you are awarded license to become an insurance agent:

IC 33: Prelicencing Exam for Life Insurance agent.

IC 34: Prelicencing Exam for General Insurance agent.

You have to register in this IRDA website for above exams – take help of Insurance organisation for which you want to become an agent while doing this.

While I could not locate the syllabus & course materials for IC-34, you can click here to download the syllabus and sample papers for the course IC-33.

Trust above info has given you a good understanding about how to become an Insurance agent.

Trust above info has given you a good understanding about how to become an Insurance agent.

COMMENTS